Money Stress in 2025: 7 Ways to Protect Your Financial & Mental Health

Introduction

Money stress is one of the leading causes of anxiety and mental strain in today’s world. With rising costs, fluctuating markets, and growing debt levels, millions of people struggle to maintain financial stability.

In 2025, financial wellness is not just about having money — it’s about managing it wisely to protect your mental and emotional health. Combining smart financial habits with psychological awareness can reduce stress, improve decision-making, and build long-term wealth.

This guide will cover 7 practical strategies to reduce money stress, improve financial wellness, and safeguard your mental health.

1. Create a Realistic Budget

A budget is the foundation of financial wellness. Start by:

- Tracking income and expenses

- Categorizing spending (needs, wants, savings)

- Setting realistic limits for discretionary spending

Tip: Use apps like Mint or YNAB (You Need A Budget) to automate budgeting and monitor finances in real-time.

2. Build an Emergency Fund

Unexpected expenses can cause significant money stress. Aim to:

- Save 3–6 months of essential expenses in a separate account

- Use high-yield savings accounts to grow your emergency fund

- Replenish funds immediately after usage

Having a financial safety net reduces anxiety and protects your mental health.

3. Reduce and Manage Debt

Debt is a major contributor to financial stress. Strategies include:

- Debt Snowball: Pay off smallest debts first for quick wins

- Debt Avalanche: Pay debts with the highest interest rates first

- Negotiate lower interest rates with lenders

For beginners, combining micro-investing and debt repayment can help grow wealth while eliminating liabilities.

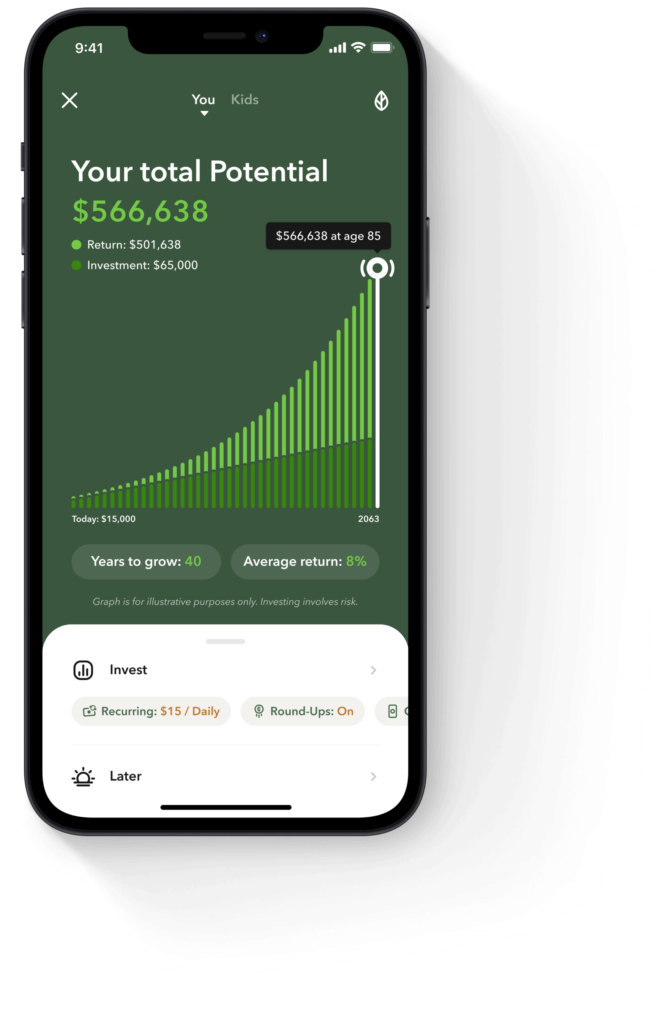

4. Automate Savings & Investments

Automation removes the stress of manual money management:

- Set up recurring transfers to savings or investment accounts

- Use apps for automated micro-investing and fractional investing

- Reinforce consistent savings habits without active effort

5. Track Spending & Financial Goals

Monitoring your financial behavior reduces surprises and stress:

- Track daily spending using apps or spreadsheets

- Set short-term and long-term financial goals

- Celebrate milestones to maintain motivation

Tracking creates awareness, reduces overspending, and promotes financial mindfulness.

6. Invest in Mental Health

Financial wellness is inseparable from mental health. Consider:

- Practicing mindfulness or meditation to reduce stress

- Seeking financial therapy or counseling if needed

- Engaging in hobbies that relieve stress without financial burden

Research shows that reducing financial anxiety improves decision-making and long-term wealth accumulation.

7. Educate Yourself About Money

Knowledge empowers confidence and reduces stress:

- Learn about budgeting, investing, and personal finance strategies

- Follow credible blogs, podcasts, and financial education platforms

- Stay updated on emerging trends like AI in personal finance, micro-investing, and sustainable investing

Start with resources like Investopedia or NerdWallet for beginner-friendly financial education.

FAQs About Financial Wellness & Money Stress

1. Can money stress affect my health?

Yes, chronic money stress can lead to anxiety, insomnia, high blood pressure, and depression.

2. How much should I save for an emergency fund?

Aim for 3–6 months of essential expenses, adjusting based on personal circumstances.

3. What is the fastest way to reduce money stress?

Creating a realistic budget, paying down high-interest debt, and automating savings are effective immediate steps.

4. Can micro-investing help with financial wellness?

Yes, starting small with automated investments builds confidence, financial literacy, and long-term wealth.

5. Should I consider financial therapy?

If money stress significantly impacts your mental health or decision-making, consulting a financial therapist can be very beneficial.

Conclusion

Financial wellness in 2025 is about more than just money — it’s about reducing stress, making informed decisions, and building long-term security. By implementing strategies like budgeting, debt management, automated savings, and investing in your mental health, you can protect both your finances and emotional well-being.

Start today: small changes in financial habits can lead to big reductions in stress and sustainable wealth growth.

Stay connected with us for more smart money tips—follow Dollar For You now on Instagram, Facebook, and Pinterest!

Know why you need us :

Managing Money Effectively- Dollar For You’s Complete Guide to Save, Invest, and Grow

Share this content:

Post Comment