How to Build Financial Resilience in Uncertain Times

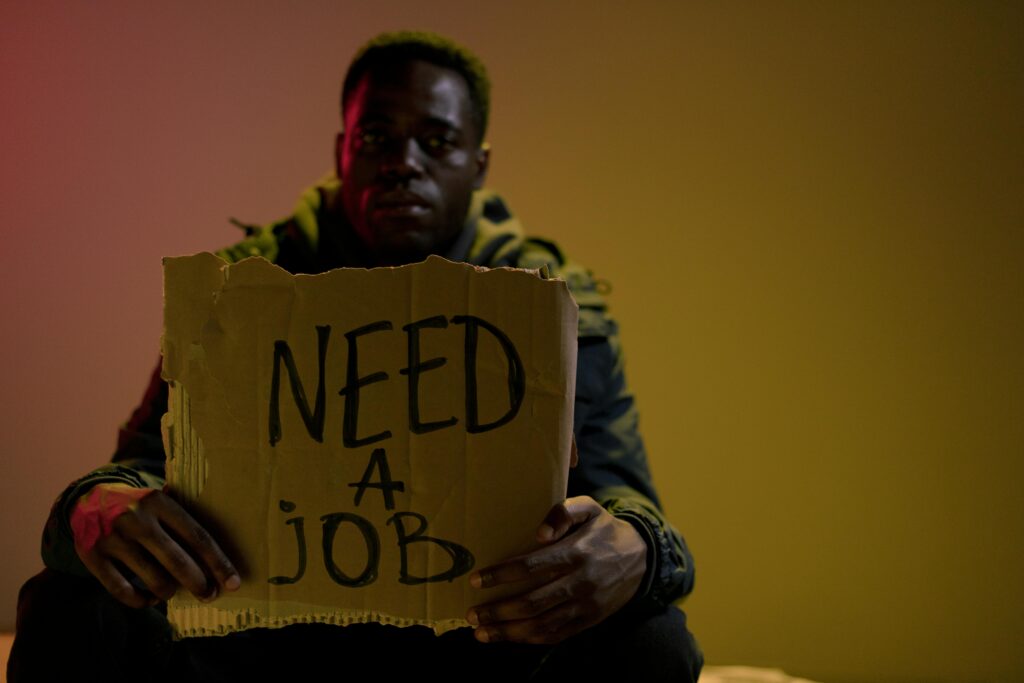

In today’s unpredictable world, financial resilience is no longer optional — it’s essential. Whether it’s rising living costs, sudden job loss, or global economic shifts, having the ability to withstand financial shocks gives you peace of mind and long-term security.

The good news? You don’t need a six-figure salary to achieve it. With the right strategies, anyone can strengthen their financial foundation.

1. Master Your Budgeting Habits

A strong budget is the backbone of financial resilience. It helps you track spending, identify wasteful expenses, and stay in control. Start by listing your fixed expenses (rent, utilities, debt payments) and then allocate what remains to savings, investments, and lifestyle choices.

👉 If you’re new to budgeting, check out our guide on smart budgeting strategies. It breaks down how to create a budget that actually works in real life.

2. Build an Emergency Fund

An emergency fund acts as your safety net during job loss, medical emergencies, or unexpected bills. Aim for 3–6 months of living expenses in an easily accessible savings account. Even saving a small amount consistently will grow over time.

Tip: Automate your savings so a portion of your paycheck goes directly into your emergency fund.

3. Diversify Your Income Streams

Depending on one source of income is risky. Side hustles, freelancing, or passive income opportunities can protect you from financial instability.

👉 Explore these best side hustles to start in 2025. Many require little to no upfront investment but can provide extra cash flow when you need it most.

4. Invest for Long-Term Stability

Investing, even with small amounts, builds resilience by growing your wealth over time. You don’t need to be a stock market expert — micro investing apps now make it easy to invest with as little as $5.

👉 Learn how micro investing can help you grow wealth. It’s a beginner-friendly way to get started.

5. Manage Debt Wisely

Debt can quickly erode financial stability. Prioritize paying off high-interest debt first, while making minimum payments on the rest. Methods like the avalanche method (highest interest first) or snowball method (smallest balance first) can accelerate your journey to debt freedom.

👉 Read our breakdown of debt repayment methods to choose the right approach for your situation.

6. Strengthen Your Financial Mindset

Resilience isn’t just about money — it’s also about mindset. Stay informed, practice patience, and make decisions based on long-term goals rather than short-term emotions.

Remember, financial resilience is a journey. Every step you take — from saving a little more to learning about new income opportunities — brings you closer to lasting security.

Final Thoughts

Building financial resilience takes time, but the payoff is invaluable: reduced stress, stronger security, and freedom to handle life’s uncertainties. By budgeting wisely, creating safety nets, investing gradually, and managing debt, you can future-proof your finances.

Start today with one small step — because the sooner you begin, the stronger your resilience will be tomorrow.

Stay connected with us for more smart money tips—follow Dollar For You now on Instagram, Facebook, and Pinterest!

Know why you need us :

Managing Money Effectively- Dollar For You’s Complete Guide to Save, Invest, and Grow

Share this content:

Post Comment