How to Stop Living Paycheck to Paycheck — 7 Realistic Habits That Work

Introduction

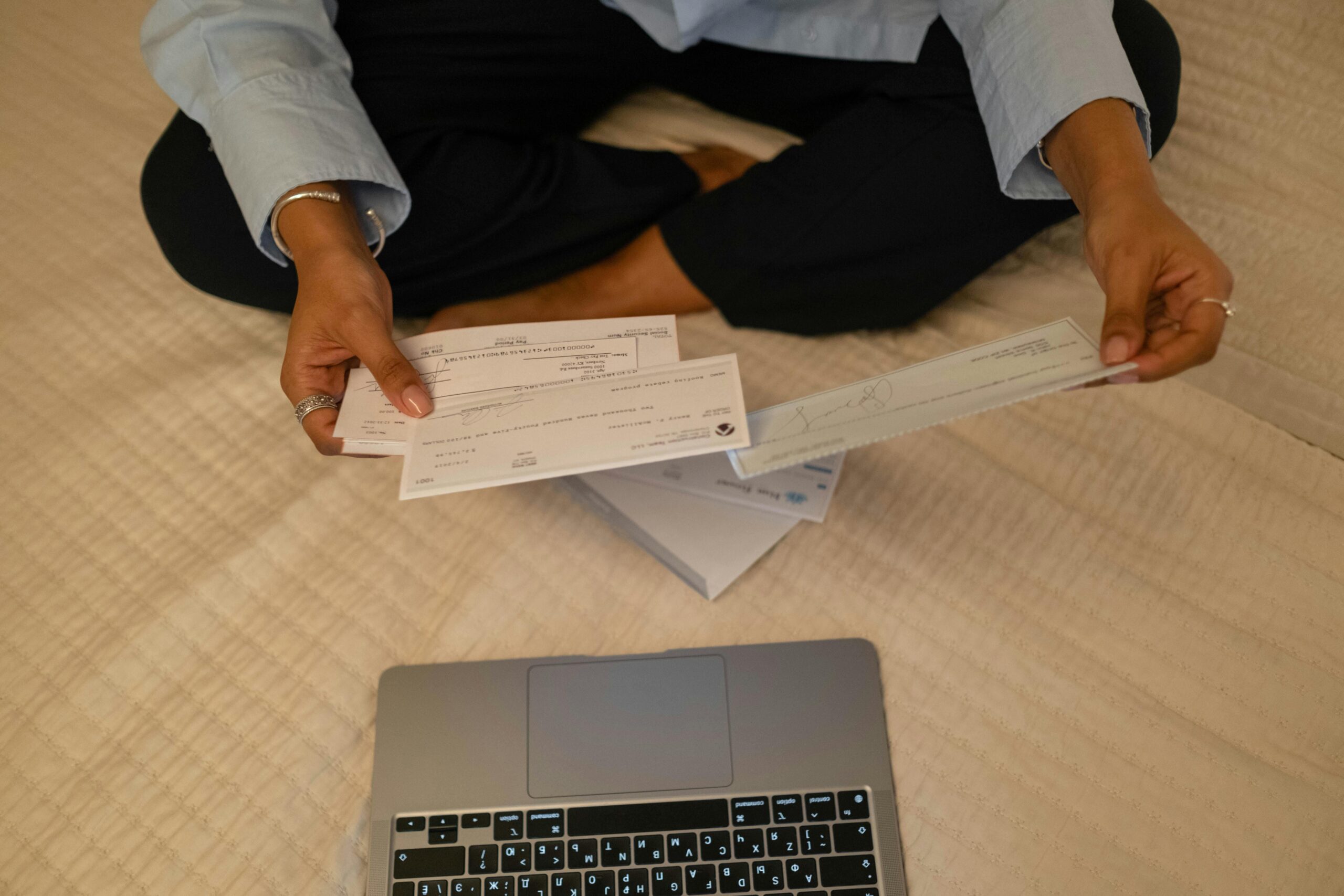

If you constantly find yourself running out of money before your next payday, you’re not alone. Millions of people live paycheck to paycheck, no matter how much they earn. The good news? You can break this cycle — without needing a second job or a financial degree.

In this post, we’ll explore realistic, proven habits that can help you stop living paycheck to paycheck, gain control over your finances, and finally start saving for your future.

1. Track Every Dirham (or Dollar) You Spend

The first step to stop living paycheck to paycheck is knowing where your money goes. Most people underestimate their expenses — especially small daily purchases like coffee or delivery fees.

✅ Action step:

Use a budgeting app like Mint or YNAB (You Need a Budget) to categorize your spending.

You can also automate savings using an automated savings app to help you stay consistent.

2. Create a Realistic Budget — and Stick to It

Budgeting doesn’t mean restricting yourself; it’s about giving every dirham a purpose.

Start with the 50/30/20 rule:

- 50% for needs (rent, groceries, utilities)

- 30% for wants (dining, entertainment)

- 20% for savings or debt repayment

💡 Tip: If you find budgeting hard, try automating it with savings apps that round up spare change from every purchase.

3. Build a Small Emergency Fund

Even saving AED 500–1000 can make a big difference when an unexpected bill hits.

An emergency fund prevents you from using credit cards or loans when something goes wrong.

📘 Pro tip: Keep this fund in a separate account — not your main spending account — so you’re not tempted to touch it.

4. Automate Your Finances

Automation helps you stay consistent even when life gets busy.

Set up automatic transfers to your savings right after payday. This way, saving becomes effortless.

👉 Read more: Best Automated Savings Apps to help you save without thinking.

5. Pay Off High-Interest Debt First

High-interest debt — especially credit cards — drains your income every month. Focus on paying these off before anything else.

Try the debt snowball method: pay off your smallest debt first for motivation, then move to larger ones.

6. Reduce Lifestyle Inflation

When your income increases, it’s tempting to upgrade your lifestyle — but that’s how the paycheck-to-paycheck trap continues.

Instead, pretend your raise didn’t happen and funnel the extra money into savings or investments.

Over time, this small discipline builds wealth quietly in the background.

7. Find Simple Ways to Earn Extra Income

You don’t need to work 80 hours a week — even small extra income streams can make a difference.

Try real money apps, freelance gigs, or online surveys.

Explore: Real Apps That Pay Real Money — simple ways to earn from your phone.

Final Thoughts

Breaking free from the paycheck-to-paycheck cycle doesn’t happen overnight — but with consistency and smart habits, it’s absolutely achievable.

Start small. Automate your savings, track your spending, and focus on paying off debt. Every good habit adds up, helping you build financial freedom one payday at a time.

Stay connected with us for more smart money tips—follow Dollar For You now on Instagram, Facebook, and Pinterest!

Know why you need us :

Managing Money Effectively- Dollar For You’s Complete Guide to Save, Invest, and Grow

Share this content:

Post Comment