Debt Snowball vs Avalanche: Which Works Better?

Introduction

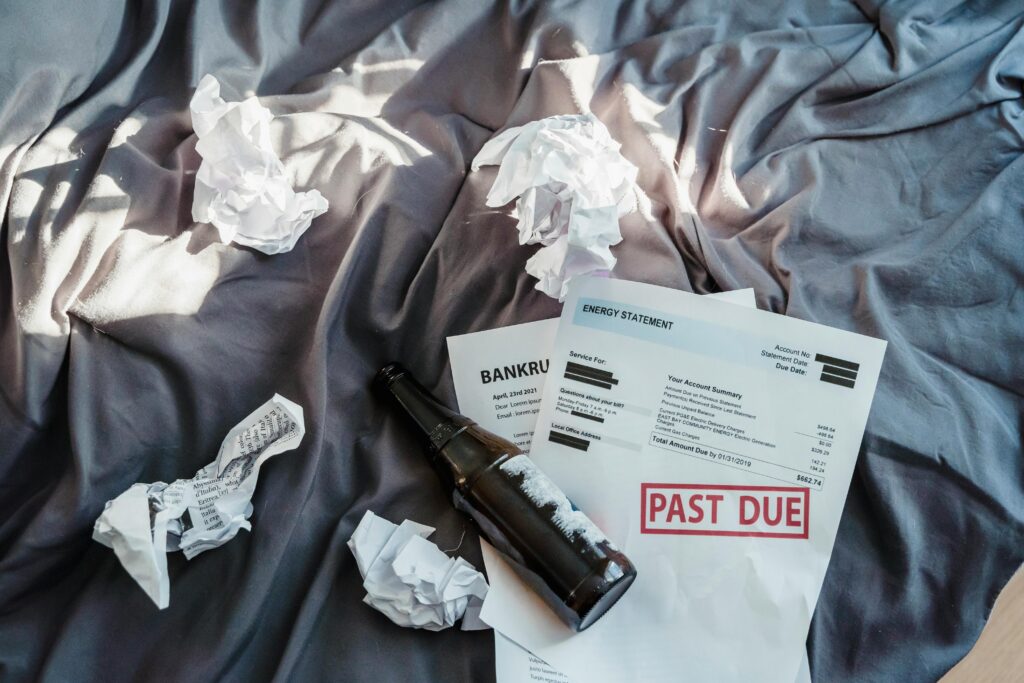

Debt can feel like a heavy weight holding you back from financial freedom. When you’re juggling multiple credit cards, personal loans, or student loans, choosing the right repayment strategy can make a world of difference. Two of the most popular debt repayment methods are the Debt Snowball and the Debt Avalanche.

Both strategies are effective, but the best choice depends on your personality, financial situation, and motivation style. In this guide, we’ll break down both methods, their pros and cons, and help you decide which one works better for you.

What is the Debt Snowball Method?

The Debt Snowball focuses on building momentum by paying off the smallest debt first.

How it Works:

- List all your debts from smallest balance to largest balance (ignore interest rates).

- Pay the minimum on all debts.

- Put any extra money toward the smallest debt until it’s gone.

- Once the smallest debt is paid, roll that payment into the next smallest debt.

- Repeat until you’re debt-free.

👉 Think of it like rolling a snowball—starting small, but growing bigger as it goes.

Example:

- Credit Card A: $500 at 18%

- Credit Card B: $1,200 at 20%

- Student Loan: $5,000 at 6%

You’d pay off Credit Card A first, even though it doesn’t have the highest interest rate.

Pros of Debt Snowball:

- Quick wins keep you motivated 💪

- Simple and easy to follow

- Builds financial discipline and momentum

Cons of Debt Snowball:

- You might pay more in interest over time

- Not the fastest way to become debt-free

What is the Debt Avalanche Method?

The Debt Avalanche prioritizes minimizing interest costs by targeting the highest interest rate first.

How it Works:

- List all your debts from highest interest rate to lowest interest rate.

- Pay the minimum on all debts.

- Put any extra money toward the highest-interest debt first.

- Once it’s gone, move to the next highest.

👉 Think of it like an avalanche—tackling the steepest slope (interest) first.

Example:

- Credit Card A: $500 at 18%

- Credit Card B: $1,200 at 20%

- Student Loan: $5,000 at 6%

You’d pay off Credit Card B first (20% interest), saving money on interest.

Pros of Debt Avalanche:

- Saves the most money in interest 💰

- Gets you debt-free faster in many cases

- Great for mathematically disciplined people

Cons of Debt Avalanche:

- Can take longer to see progress

- May feel discouraging if the first debt takes years to clear

Debt Snowball vs Avalanche: Which One Works Better?

| Feature | Debt Snowball ❄️ | Debt Avalanche ⛰️ |

|---|---|---|

| Focus | Smallest balance first | Highest interest first |

| Best For | Motivation & momentum | Saving money |

| Psychological Boost | High ✅ | Medium ❌ |

| Total Interest Saved | Lower ❌ | Higher ✅ |

| Speed to Debt Freedom | Slower ❌ | Faster ✅ |

The Verdict:

- Choose Snowball if you need quick wins to stay motivated.

- Choose Avalanche if you’re disciplined and want to save the most money.

Tips to Maximize Either Method

Regardless of which method you choose, these strategies can speed up your debt repayment:

- Create a budget – track income and expenses so you know where your money goes.

- Cut unnecessary spending – redirect money to debt payoff.

- Increase income – side hustles, freelancing, or selling unused items.

- Automate payments – never miss a due date and avoid late fees.

- Stay consistent – debt repayment is a marathon, not a sprint.

Final Thoughts

Both the Debt Snowball and the Debt Avalanche are proven strategies to eliminate debt. The “best” method depends on your mindset: if motivation drives you, go with Snowball; if math drives you, Avalanche is your friend.

What matters most is not the method—but starting today. The sooner you begin, the sooner you’ll enjoy the peace of a debt-free life.

Stay connected with us for more smart money tips—follow Dollar For You now on Instagram, Facebook, and Pinterest!

Frugal Habits That Saved Me $10,000 in a Year

What Is a Good Credit Score in the U.S.?

Share this content:

2 comments