How to Rebuild Credit Without a Credit Card

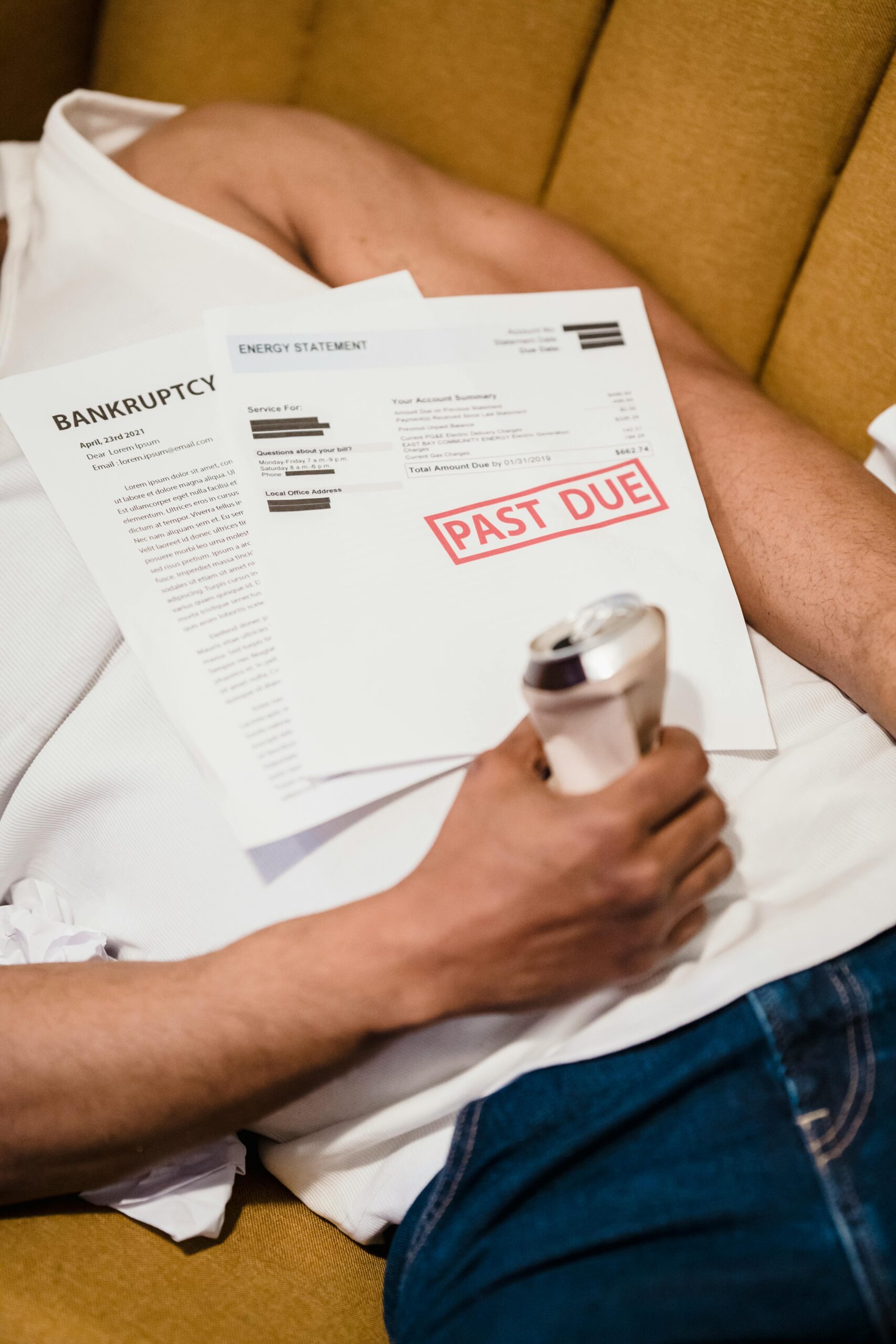

Introduction

Rebuilding credit without a credit card may feel challenging, but it’s absolutely possible. While most advice points to getting a secured card, not everyone qualifies—or even wants another card. The good news? You don’t need a credit card to start repairing your financial reputation.

In this guide, we’ll cover proven strategies to rebuild credit without using a credit card, so you can improve your score, lower financial stress, and open the door to better loan and housing opportunities.

Why Rebuilding Credit Matters

Your credit score isn’t just about borrowing money. It affects:

- Renting an apartment

- Getting approved for utilities or a phone plan

- Qualifying for better loan rates

- Even lowering your insurance premiums

A damaged credit score can cost thousands over time. But credit systems are designed to reward consistent, responsible financial behavior—and you don’t need a credit card to show that.

1. Report Your Rent and Utility Payments

Most people pay rent and utilities every month, but these payments often go unreported to credit bureaus. By using services like Experian Boost or rent-reporting platforms, your on-time payments can be added to your credit file.

✅ Pro Tip: Always pay rent and utilities on time. Just one late payment can hurt instead of help.

2. Consider a Credit Builder Loan

Credit builder loans are designed specifically to help people rebuild credit. Offered by many community banks and credit unions, they work like this:

- You borrow a small amount (e.g., $300–$1,000).

- The money is placed in a secured savings account.

- You make monthly payments, which are reported to credit bureaus.

- Once the loan is paid off, you receive the money.

This creates a positive payment history—without needing a credit card.

3. Use Automated Savings Apps for Financial Discipline

Building credit is about more than just payments—it’s about demonstrating responsible money management. An automated savings app helps you set aside small amounts regularly, ensuring you always have funds for bills.

This prevents late payments and strengthens your financial profile. You can check out our guide on the best automated savings apps to get started.

4. Become an Authorized User on a Trusted Account

If you have a family member or close friend with a strong credit history, ask to be added as an authorized user on their credit card.

- You don’t need to use the card.

- Their positive history will reflect on your report.

- Just be sure they manage their account responsibly—otherwise, it could harm your score.

5. Pay All Bills on Time (Every Time)

Payment history makes up 35% of your credit score, making it the single most important factor. Even without a credit card, paying your:

- Phone bill

- Car loan

- Student loan

- Utilities

…on time, every time, builds trust with lenders.

✅ Pro Tip: Set up autopay or digital reminders to avoid missed due dates.

6. Avoid Unnecessary Hard Inquiries

Each time you apply for new credit, a hard inquiry appears on your report. Too many in a short time can lower your score. While rebuilding, focus on managing your existing accounts instead of applying for multiple new ones.

7. Monitor Your Credit Regularly

You can’t fix what you don’t track. Monitoring your credit report helps you:

- Spot errors and dispute them quickly

- Track progress as your score improves

- Stay motivated by seeing positive changes

Websites like AnnualCreditReport.com allow you to check your report for free, while credit monitoring tools provide ongoing updates.

Final Thoughts

Rebuilding credit without a credit card is not only possible—it’s achievable with consistency and patience. By reporting rent and utilities, using credit builder loans, automating savings, paying bills on time, and avoiding unnecessary inquiries, you can steadily strengthen your financial foundation.

Remember, credit rebuilding is a marathon, not a sprint. Every responsible choice today brings you closer to financial freedom tomorrow.

Stay connected with us for more smart money tips—follow Dollar For You now on Instagram, Facebook, and Pinterest!

Know why you need us :

Managing Money Effectively- Dollar For You’s Complete Guide to Save, Invest, and Grow

Share this content:

3 comments